With electric fleets expanding across Italy, from last-mile delivery to public transport, fleet operators are under pressure to reduce charging costs while improving operational efficiency. One emerging technology making a tangible impact is Plug & Charge, based on the ISO 15118 protocol. As a commercial charger provider, iocharger offers commercial EV Chargers with fully Plug&Charge –enabled AC and DC fast chargers, helping businesses simplify their charging processes, reduce overhead, and unlock incentives.

What Is “Plug & Charge”?

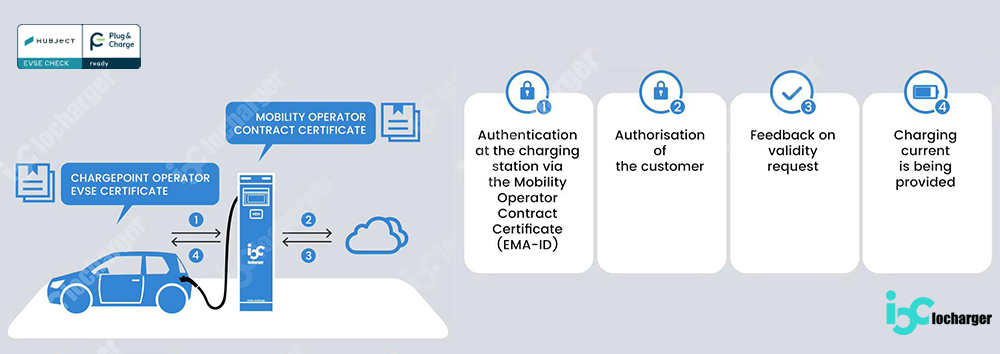

ISO 15118’s Plug & Charge standard defines a PKI-based protocol enabling an EV and charger to exchange digital certificates upon connection, automatically authenticating and authorizing payment without external devices. This end-to-end encrypted communication prevents man-in-the-middle attacks and fraud, ensuring secure, tamper-proof transactions.

How iocharger’s Plug & Charge Solution Benefits Italian Fleets?

1. Lower Administrative Costs

With Plug & Charge, drivers simply connect the vehicle and walk away. This reduces time spent on managing RFID cards or handling receipts. Fleet operators can reduce billing errors, reconciliation time, and support tickets, especially helpful for fleets with dozens or hundreds of vehicles charging daily.

2. Faster, More Reliable Charging

iocharger’s Plug & Charge–ready DC chargers support seamless backend integration via OCPP 2.0.1. Once an EV is plugged in, it’s authenticated in seconds. This improves first-time success rates, meaning fewer failed sessions and more reliable operations for commercial use.

3. Smart Energy Use

Our chargers integrate with EMS or fleet platforms to help operators shift charging to off-peak hours, reducing electricity costs by up to 10–15%, depending on local tariffs and grid conditions. Italy’s time-of-use pricing structure makes this particularly effective.

Italian Incentives & Tax Benefits

1. Equipment Grants

DC chargers < 50 kW receive €1 000;

50–100 kW up to € 30,000;

> 100 kW up to €75,000 per unit.

Source: Italy’s Recovery and Resilience Plan – Annex 5.2: Sustainable Mobility

2. Installation Tax Credit

50% of the capex is deductible over five years, applicable only to equipment installed between 2024-2026 (Art 16 of Italy’s 2024 Budget Law).

Additional requirement: Must utilize at least 25% renewable energy (e.g., through integrated photovoltaic systems).

3 . Fringe-Benefit Tax

Electric company vehicles incur just 10% of cost-per-km taxation vs. 50% for ICE vehicles, making BEV operations 40% more tax-efficient.

4.EU & National Co-Funding

Up to 40% support for infrastructure deployment under various EU and national programs.

*Applies only to publicly accessible charging stations (e.g., logistics park chargers must allocate ≥20% capacity to third-party users).

These combined incentives can trim the total cost of ownership by 10%–20% and drive payback into a 2–4-year window.

Interested in Learning More?

We’re happy to share more about how Plug & Charge–ready chargers from iocharger can fit into your electrification strategy, whether you’re running delivery vans, shuttle buses, or municipal vehicles. Contact our team or book a product demo today.

Зарядные устройства для коммерческого транспорта и автопарков

Идеально подходят для офисных зданий, парковок и автопарков. Эти зарядные устройства поддерживают OCPP 2.0.1 и Hubject ISO15118 Plug&Charge.

Основные особенности: - Высокая стабильность при нагрузке - Интегрированные системы оплаты в точках продаж - Автоматическое распознавание пользователя и беспрепятственные бесконтактные платежи

Быстрые зарядные устройства постоянного тока

С мощностью от 60 до 240 кВт наши зарядные устройства постоянного тока обеспечивают быструю зарядку в оживленных общественных местах, таких как автомагистральные стоянки и городские транспортные узлы. 21,5-дюймовый цифровой дисплей позволяет размещать рекламу на месте и улучшает как пользовательский опыт, так и рентабельность инвестиций оператора.